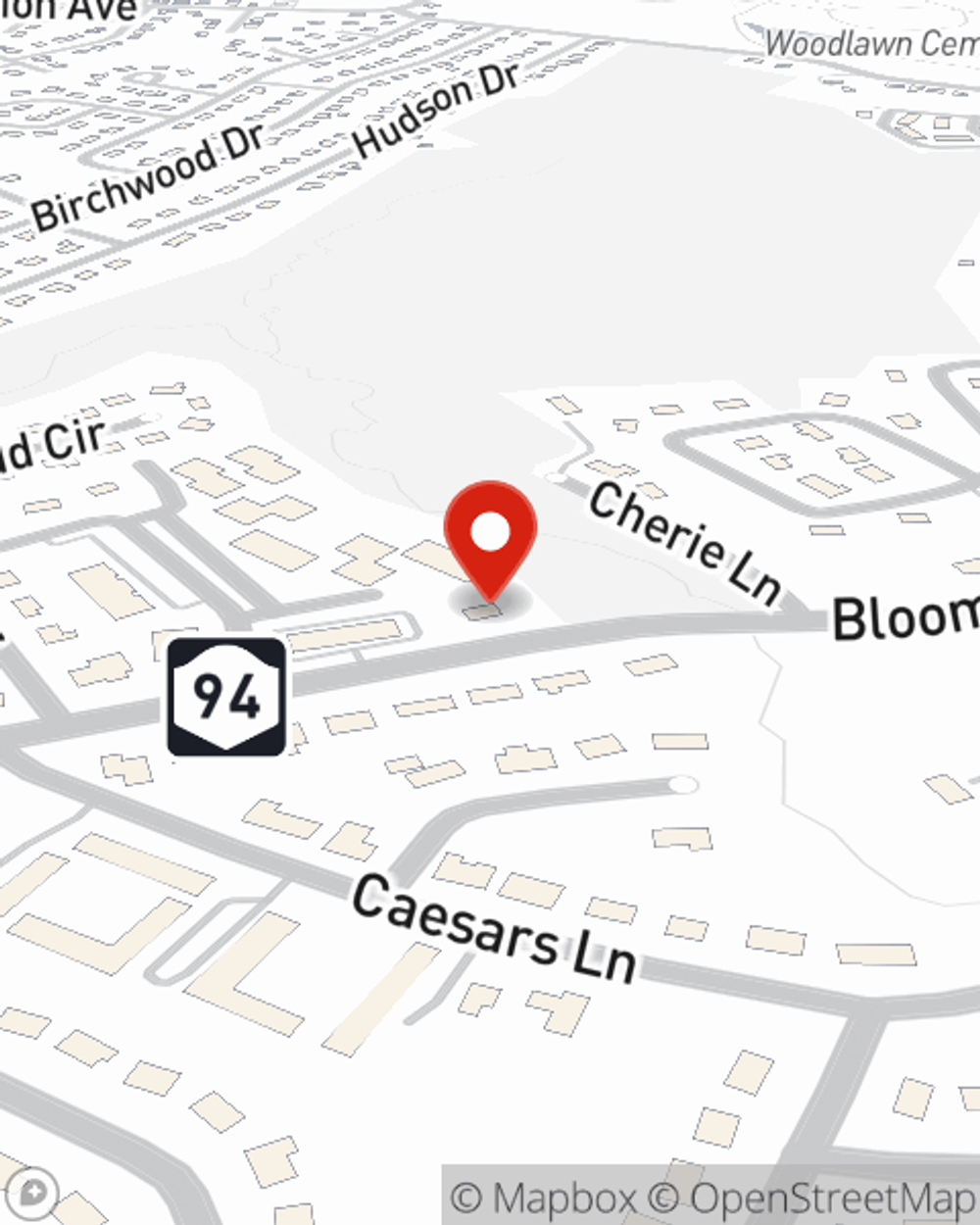

Business Insurance in and around New Windsor

Looking for protection for your business? Look no further than State Farm agent Steve Cooney!

Cover all the bases for your small business

Insure The Business You've Built.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a HVAC company, an art gallery, a fabric store, or other.

Looking for protection for your business? Look no further than State Farm agent Steve Cooney!

Cover all the bases for your small business

Cover Your Business Assets

Your small business is unique and faces specific challenges. Whether you are growing a book store or a toy store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Steve Cooney can help with business continuity plans as well as key employee insurance.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Steve Cooney's team to discuss the options specifically available to you!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Steve Cooney

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.